INVESTMENT BANKING

|

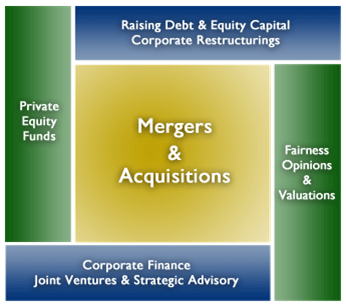

The financing solutions you need are just as unique as your business. We provide a wide spectrum of business and corporate financing for companies in early stage growth through to large, established organizations. Whatever your specific need may be – Growth Capital, Private Equity Fund Raising, Expansion Capital, – Excelorr does it all.

Whether you are looking to buy a business in India or exit, our team understands both business dynamics and people dynamics. We appreciate your need to connect with the right buyer or seller at the right price and our role is to help you buy or sell. We specialize not only in structuring the right solution for your needs but also in handholding you well beyond transaction closure.

Our services combine multiple sector knowledge, cross-border expertise and deal-making skills to maximize value creation for our clients. We help structure and execute a broad spectrum of buy-side and sell-side transactions. Incisive research on industry trends helps us track, identify and evaluate potential targets, sellers or investors.Our services help you choose the right partner to fund your growth. You benefit from our expertise across the entire Private Equity lifecycle – identification, initiation, structuring, execution, and closure. Relationships with investors help us bring a better understanding of promoter expectations to the table.

We deliver an integrated advisory approach to our clients that draws upon our strengths in providing strategic and tactical expertise, global reach, critical industry knowledge, structuring financing innovations & solutions, and our experience as the “advisor of choice” in private equity deals.Clients eyeing both organic and inorganic growth can benefit from a spectrum of advisory services. Our multi-disciplined approach affords our middle-market clients access to insights & strategies usually reserved for much larger companies.

Our expertise enables us to develop creative and practical solutions that can exceed the expectations of our clients.